-

Conversational Shopping

Most AI tools respond when prompted. You ask, they answer. But a new kind of AI is emerging, one that doesn’t just wait for instructions,…

-

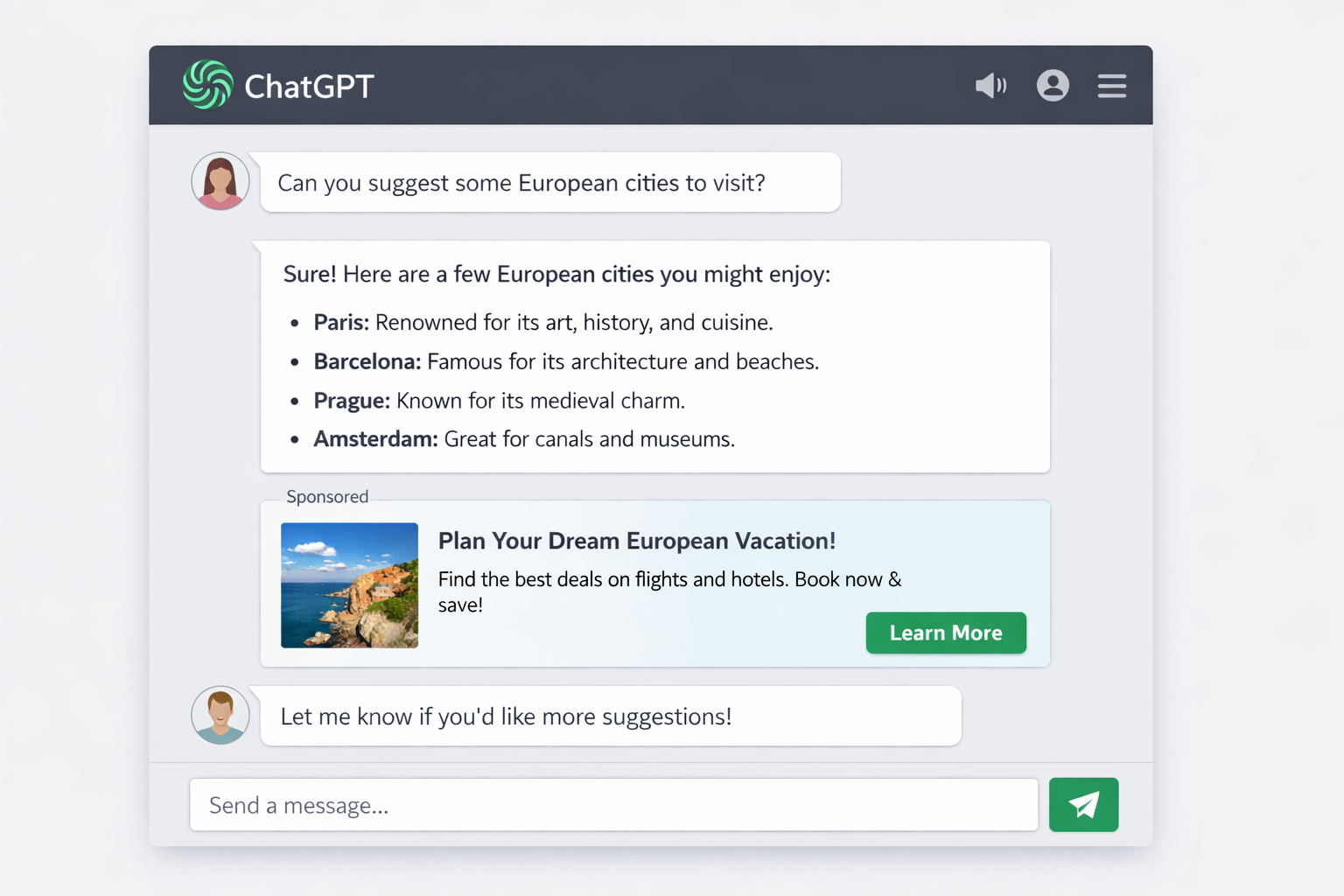

ChatGPT Ads Are Here

Advertising creeps into a safe space If you’ve ever had a good conversation interrupted by a newsletter banner or an ad pop-up, imagine that happening…

-

Spotlight on Good News

There’s a concerted effort among news organizations today to leave the audience on a high note. Popular series include Steve Hartman’s Kindness 101. The Uplift…