Below is a RFP we submitted to a B2B farming company a few years ago. I just recently came across our proposal again and wondered what you might propose. Different methods? Different tools? Different process? And did we get the job?

The Background for this study was provided by the client in the RFP and the Objective was identified after a detailed conference call with the client, including their internal marketing department.

Background

RM Co. sells industrial farm tools to wholesalers around the world and wants to expand their collection of products to sell. Currently they make commercial irrigation and fertilization systems and want to get into the fertilizer products farmers spread using their machines.

Objective

Identify unmet needs with RM Co.’s current clients, the unmet needs of both customers and prospects with fertilizer products, the most useful and appealing characteristics and features of a better fertilizer, biggest pains, and any others areas prospects and customers would like to see improved regarding their fertilizing process.

Plan of Action

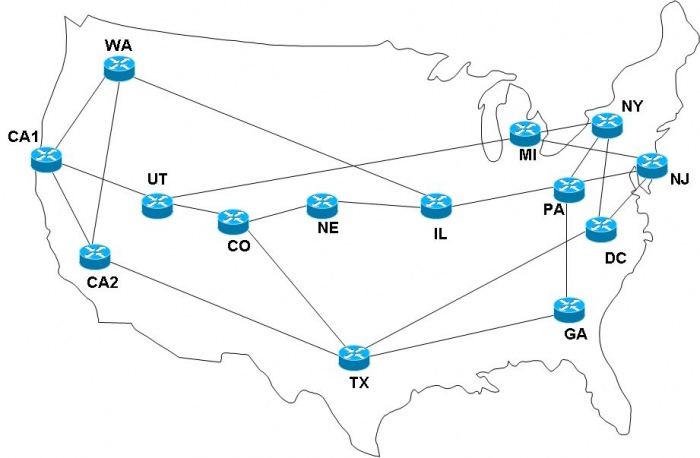

Obtain list of RM Co’s best clients in different industries. Research and identify their farming specialties, volume of fertilizer and brands used, prices for sale, and delivery methods offered. Additionally, identify list of RM Co.’s current and future competition (direct & indirect), and list their farming specialties, what makes them a competitor, their fertilizer machinery, their volume of fertilizer and brands used, and delivery methods offered.

- Secondary Research: Amount used/year, brands used, price ranges paid, and delivery method choices.

- Competitive Questionnaire: Design program, administrator, and analyze survey questions among farmers across the globe to quantify unmet needs, work priorities, and potential new fertilizer features. Survey will be designed in English and translated in 6 other languages to accommodate the varied geography of RM Co.’s clients.

Tour multiple RM Co.’s global plants in-person, take notes/videos/pictures. Interview farmers on-site, take notes/videos/pictures.

- Ethnography: Go to the client to observe workers and go on-site to observe farmers using fertilizer and fertilizer machines.

Interview RM Co. employees, RM Co. stakeholders, and RM Co. product users.

- IDIs and Online Focus Groups with employees off-site, stakeholders online, & farmers on-site about challenges identified in the survey. Analyze the transcripts and provide insights into attitudes, behavior, and values of all segments.

Work with RM Co. & their advertising agency to design effective ad strategies and tangible concepts for consideration/testing among the different target segments identified.

- IDIs and online focus groups with segmented farmers and show new concepts developed by RM Co.’s advertising firm.

Analyze the transcripts and provide insights into farmer feedback received.

- Present results as live actionable findings that directly address RM Co.’s research objectives, including an overview of the fertilizer Industry, aerial view of methods used, brands preferred, unmet needs, etc., with suggestions for next steps, improvement, and landmines to avoid.

- Data Handover: RM Co. will receive all the research materials, including the written survey, the discussion guide, raw survey data collected (spreadsheets, media files), cross tabulations, infographics, and the final slide deck (w/speaker notes).\

We did get the job and the client was thrilled to be able to get InsideHeads. That said, we know there are many (good) ways to address a challenge, so we’re curious, how would you have done it?