Tag: tips

Yam or Sweet Potato?!

Sweet potatoes are prevalent in the Americas and come in a number of varieties of substance and sweetness. These are typically the orange colored ones, though you might see them in purple and other colors.

Yams, on the side of the tubular continuum, are common in Africa and are more fibrous and whiter on the inside than a sweet potato. In fact, you likely have never seen a Yam.

Bonus Tip: Best Scalloped Sweet Potato Dish: 3 easy ingredients. You got this.

Why are Some Marketing Research Studies Doomed to Fail?

Regardless how you intend to get your data, the first few steps to achieving success are often brushed over or pushed aside on the way to the finish line. Before identifying the best means of engagement, it’s critical to clearly define both the research objective and the target audience.

- Where you’re going and why

- Who you need to interview and why.

Like a beacon of light, a well considered objective propels a project purposely forward to the finish line. Without it, findings flail and resulting recommendations are at risk.

Knowing who to interview to achieve the objective must also be clearly defined. Recruiting appropriate participants starts with a client conversation to identify demographic, lifestyle, and behavioral attributes of prospective participants. Well designed, unbiased screening questionnaires and extensive identity verification procedures ensure accurate and effective recruiting.

Despite the simplicity of this secret sauce, InsideHeads surveyed research buyers on LinkedIn and discovered “actionable insights” to be “most desired”, yet also “rarely achieved”.

InsideHeads clients always receive pointed recommendations. Born from a deep understanding of both data collection and strategic direction, InsideHeads delivers intelligent insights that will move your unique initiatives forward.

More Tips

Which Online Qual Research Method Has the Lowest CPI?

Calculating cost-per-interview (CPI) of different qualitative research methods can be an eye-opening exercise. Excluding recruiting and incentives, which vary, we can estimate typical costs of different methods.

CPI estimates below assume:

- 4 focus groups

- focus facility & support

- project management

- moderator fees (guide design, interviews, & analysis)

In-Person Groups – Face to Face in Real Time

6-8 Participants for 2 hours

Average CPI $650

Multi-Media Bulletin Board Over Time

15-20 Participants for 3-5 days

Average CPI $353

Text Chat in Real Time

15-20 Participants for up to 2 hours

Average CPI $191

Webcam (Video Chat) in Real Time

3-5 Participants for up to 2 hours

Average CPI $988

Contact InsideHeads for a free estimate on your next online marketing research study. Call +1-877-In-Heads or email info@insideheads.com.

When Did Online Qual Begin?

The moment people could connect and communicate online, researchers were there. In the beginning the research was technical, paving the way for a vast network of open communication that was to follow.

As this virtual network of people grew, marketing researchers strapped on their boots and began exploring new ways of mining and collecting data. It wasn’t long before social researchers suited-up and started using email, group chats, and bulletin board systems to gather information. All of these initial efforts cleared the way for what is now known as online qualitative research.

While the first online focus group via group text was conducted by Marian Salzman in a pimped-out AOL chat room in 1992, it was actually research boards that came first. As early as 1984, when the “internet” was limited and accessible by only government researchers and universities, one student at Syracuse University was using a bulletin board system over NSFNET to interview students at UCLA.

Learn more about the history of online qualitative research in Qual-Online, the Essential Guide, available on Amazon.

Who Provides the Best Marketing Research Platforms?

When conducting marketing research online, it’s important to understand and implement the technology required for your target market. So who do you tap for the best research platforms: a company who knows technology, or a company who knows research?

Let’s look closer at what makes the best online marketing research platforms successful:

Mobile Friendly

Today, online research studies need to be mobile responsive, while also accommodating older technology (some people still use desktop computers, it’s true.) While reported estimates vary, it’s safe to say that most of your online survey respondents will see it first on a smartphone.

Seamless Access

Platforms also need to be easy for all possible respondents to understand and use. With so much invested in recruiting, why send prospects to a survey that might not work? The best data collection, whether quantitative (surveys) or qualitative (online focus groups & IDIs), comes from research platforms that work seamlessly on any device, O/S, or browser.

Affordable

If you have to blow your entire budget on technology, we’ll just call that misdirected funds. The most expensive technology comes from fat tech firms who hang their hat on staying relevant and being “agile”. The best technology comes from companies who understand the market and custom design robust platforms with stable, time-tested code that eliminates the need for expensive user support. Tools like these are the secret weapons of seasoned researchers.

For your next online marketing research study, consider a company that understands technology and research. InsideHeads conducts marketing research and designs & develops the best marketing research platforms to do it correctly. From programming to presentations, InsideHeads has been conducting successful online marketing research studies since 1998.

Give us a call, you’ll like what you hear. +1(877)-IN-HEADS

Great Ideas Gone Wrong

When you hear a great idea, how do you know? The idea may sound great, but just because it has good intentions doesn’t mean it will work. At the very least, a great idea should be feasible and harmless to others.

Good Intentions

Not long ago a group of dedicated volunteers in my town got together to raise money for the local rescue squad. Their idea was to print and sell drink cards that offered a free drink at each of 6 local restaurants. The drinks were valued at $36 and the cards were priced at $20, and all the local restaurants agreed to accept them. Our town is a heavy tourist destination, so cards were given as gifts to visitors to encourage them to check-out local establishments.

Lasting Damage

People bought lots of drink cards and loads of money went to the rescue squad. Success, right? Wrong. Visitors who received the gifted drink card and attempted to use it encountered restrictions and ignorance from uninformed seasonal bar staff. So while the money was made in the moment, the damage of dissing tourists is immeasurable. Vacationers not only recount bad experiences to friends and family members, today their comments on social media reach further and linger longer. Ouch.

The drink card debacle is just one small example in the shadow of a far more substantial bad idea that occurred in Flint, Michigan. Town officials saved money in the moment, but gave way to irreversible damage down the line. Hindsight… you know what they say. So what’s the takeaway?

No Repeat

I can’t help but wonder: We all learn from our own mistakes, so why can’t we also learn from the mistakes of others? Sure, big gaffes get the news, but most mistakes only enlighten the bumbler. In today’s connected world, where is the portal to deposit our lessons learned? Facebook and Instagram are filled with accomplishments, carefully selected ‘selfies’, and emotional, envy-inducing posts. Wikipedia offers us our collectively edited facts, and millions of websites push products and self-serving information. Where is the hub for all things that went horribly wrong? All the lessons of war. Of life. A virtual library of bittersweet warnings, filled with evidence of what not to do. Or perhaps a way to tag those bits of learning amidst all that worldly web content.

With today’s technology and our tendency to share, a blunder blog sure sounds like great idea…

5 Business Trends to Watch

Originally published June 19, 2015

Business behavior can be very telling. InsideHeads identified these 5 business trends to watch that will affect market research.

1. Crowdsourcing

1. Crowdsourcing

If it’s not clear yet, social media is here to stay. The human desire to socialize and engage with others online gives savvy businesses the chance to collect feedback that is immediate, trusted, and free. Lengthy questionnaires have given way to quick polls, as attention spans of respondents wither down to seconds. Gone with consumer attention is the long term strategic planning that traditionally accompanies good marketing research. With the immediate feedback mechanism of today’s social media, businesses can (and do) post questions and problems to receive rich, real-time results. Smart brands looking towards the future are designing their virtual space with an eye on conducting more marketing research via social media.

2. BYOD (Bring Your Own Device)

2. BYOD (Bring Your Own Device)

Choice is everywhere these days and showing no signs of going away. Each of us uses a device (or multiple devices) that best meets our needs. As the lines between personal and business hours blur, businesses are realizing the advantages, and challenges (e.g., security), of implementing BYOD in the workplace. Present obstacles aside, solutions are on the horizon. Because BYOD is not a trend, today it’s a right. Successful businesses will accommodate choice and offer customized solutions across all of their marketing. Lenovo’s recent decision to issue logo options for multimedia marketing is just one example of a business bending their approach to fit the mobile world. We expect to see a lot more accommodating.

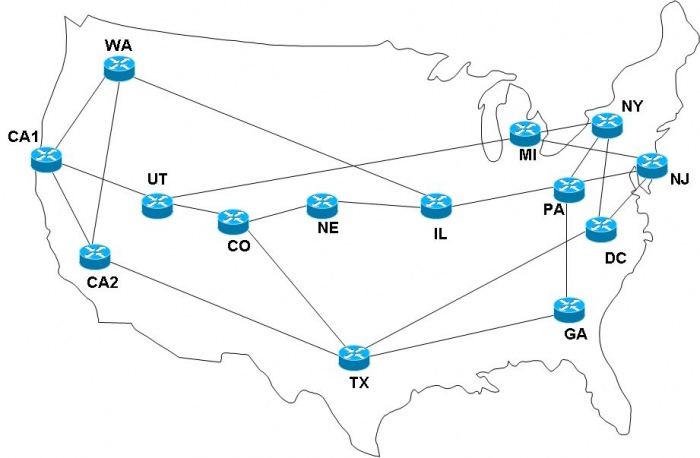

3. Access Ubiquity

3. Access Ubiquity

Access ubiquity refers to having global, high-speed broadband available to all. Just a few years ago this would have felt like a pipe dream (pun intended), but today it’s not only feasible, it’s happening. As smartphone usage continues to rise around the globe, access ubiquity is the best thing to happen to market researchers since the pencil. Researchers who are keen to know what online research tools are available and when to use them will be well poised for future success.

4. Loyalty Metrics

4. Loyalty Metrics

Marketers today are finding the ROI of existing customers is far less than acquiring new ones. Loyalty rewards build organic (read: cheap) word-of-mouth, as customers eagerly share their joy with others online. The strategies of Walgreens and JCPenney seem right on target for future success, as we anticipate the demand for assessing the effectiveness and user experience (UX) of reward programs to rise.

5. Goodbye Voicemail

5. Goodbye Voicemail

Big companies like JP Morgan Chase and Coke have taken voicemail out of their communication mix. While businesses may be driving this boat, it is in direct response to a changing culture. We may not fully understand all our aversions to leaving a voice message, it’s clear text messaging and email are tangible, trackable, and preferred. If your stock portfolio happens to be heavy in automated telemarketing, you may want to give those investments a second thought. Do not leave a message at the beep.

Online Chat Focus Groups, Limiting?

(Originally published June, 2015)

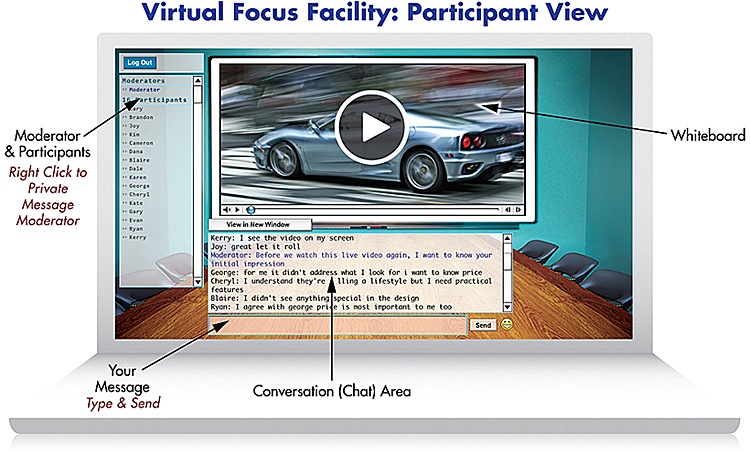

I’ve heard more than one respected professional tell me that online chat focus groups do not allow for a significant depth of response and that respondents provide short, top of mind answers of limited value.

With thousands of notches on our online focus group belt, we can soundly report that participants provide as much detail and depth as requested. The critcal elements of success lie with a skilled interviewer and a well designed discussion guide.

With thousands of notches on our online focus group belt, we can soundly report that participants provide as much detail and depth as requested. The critcal elements of success lie with a skilled interviewer and a well designed discussion guide.

When the moderator asks a question to a group responding only via text, some respondents will answer right away, then follow that up with detail in a separate comment, while others will type the whole answer before hitting send. However they answer, it is surprisingly intuitive to follow the collective conversation as it scrolls on the screen, and even easier on the back-end to pull what you need from the transcripts.

When pulling key quotes for your report, simply combine any “choppy” answers from a single respondent so you have the full picture of what the participant actually conveyed.

For example, a discussion about a new plastic storage container prompted a multitude of separate responses from a single participant over the course of several minutes. When pulled together, the brevity builds and begins to tell the full story:

For example, a discussion about a new plastic storage container prompted a multitude of separate responses from a single participant over the course of several minutes. When pulled together, the brevity builds and begins to tell the full story:

“The containers are great… the attached lids… we have an office full of the old lids, no bottoms… the new containers stack well… labels don’t fall off… [I use the new containers for] storing everything here and at home that fits… [before I discovered these containers] I struggled with cardboard boxes we assembled ourselves… we can’t use the cardboard for long term storage… falls apart.”

-Kim, 35, male, IL

If you’re curious what a synchronous online focus group via text is like, look no further than this recorded InsideHeads session here.

6 Ways to Boost Your Online Market Research

A hot topic in industry articles, white papers, and webinars today is conducting a strategic combination of quantitative and qualitative research online. While intimidating labels like multimethod research, hybrid approaches, mixed methods research, multimethodology, and even methodological pluralism (seriously?) may be flooding the airwaves, at its core the concept has always been a good one for online market research.

Quantitative studies require a significant sample size and qualitative studies require a few who freely speak. While that fundamental difference may seem to put the quant and qual fields at odds, in practice the two have always been more complementary than contradictory.

Quantitative studies require a significant sample size and qualitative studies require a few who freely speak. While that fundamental difference may seem to put the quant and qual fields at odds, in practice the two have always been more complementary than contradictory.

Increasing the richness of the data you collect and the insights you can elicit is just one reason to create a healthy mix of quant and qual. And it need not be a double-whammy to your research budget. At InsideHeads we consider small budgets to be a healthy challenge!

Here are 6 simple, cost effective quant/qual add-ons to consider when designing your next market research study:

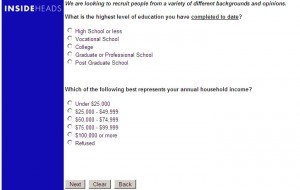

1. Give your screener a boost

While you have prospective recruits completing your online screening questionnaire, consider directing qualified respondents to complete additional questions for an added incentive prior to their selection for an interview. Not only is it a good way to further qualify recruits, you’ll also collect a sizeable amount of quantifiable information. The added incentive cost is a small price to pay for getting valuable data in advance of an in-depth interview (IDI) or online focus group.

2. Invite participants to engage in other ways

Working a multimedia reply into your online questionnaire is crazy simple. Regardless which platform you’re using to create your survey, consider branching respondents based on their answers to a page that instructs them to do something else that will bring clarity or depth to their answer. Ask respondents to call a designated phone number and leave a detailed audio explanation, or ask them to email a photo or video before continuing. All viable requests you can layer into your survey and track files received by name, email, or a preassigned ID number.

3. Not all homework is bad

Converse to the idea of working qualitative responses into your quantitative study, consider incorporating activities before or after a single or group interview. Whether it’s a shopping assignment, a diary, collage, video request, or some other activity, research participants are quite good at meeting whatever expectations you set in the recruiting process. Pay recruits appropriately for any homework time and you’ll be pleased how much the added information will enrich your discussions.

4. Think ahead to future research efforts

Whether you’re running an online questionnaire or screener, it’s always a good idea at the end to ask respondents if they’re interested in participating in future research, should they not qualify for the study at hand. Having a list of willing and eligible partipants at the ready will prove handy the next time you have questions that need answering. Even a small sample size can offer valuable insights. More than once I’ve seen a website halt release of a feature based on a few usability studies done using a free screenshare platform.

5. Get a little social

It’s difficult to ignore the impact the internet has had on our social lives. The sheer volume of information, valuable or not, is enough to make any budding Data Scientists drool. The good news is that you don’t need an expensive tool to find good stuff in this vast space. The key is to have a working knowledge of boolean search methods, and some insight into Google’s research gold mines, including public data, scholarly publications, and consumer surveys . Marketers are even using social media sites like Facebook, Google+, Twitter, Pinterest and others for crowdsourced feedback to burning questions.

6. Design before device

Probably the most important tip for saving money on your next research study and keeping your objective in clear sight is to design your study first before you pick a tool or platform. Begin with the desired end result and work backwards and you’ll not only understand the best path to success, you’ll also find the best device for the job. Always fabulous, sometimes even free!

![]() For more information on creative research approaches that deliver, contact the nice folks at InsideHeads.

For more information on creative research approaches that deliver, contact the nice folks at InsideHeads.